11/12/2024 av Kistofos

INVITATION TO JOIN LAWSUIT AGAINST AKER CAPITAL AS, THE BOARD AND CEO OF SOLSTAD OFFSHORE ASA, AND/OR AGAINST PARETO SECURITIES AS

.

Read the letter as a PDF here.

1. INTRODUCTION

On 16 May 2024, Kistefos AS and Kistefos Investment AS (jointly "Kistefos") filed a lawsuit against the board members and CEO of Solstad Offshore ASA and against Aker Capital AS (Case no. 24-078941TVI-TOSL/04). On the same day, Kistefos filed a separate lawsuit against Pareto Securities AS, claiming damages (Case no. 24-078937TVI-TOSL/04). Subsequently, the cases have been merged for joint proceedings before Oslo District Court with the main hearing scheduled for a period of 10 weeks from 7 October 2025. In letters of 1 March 2024, Kistefos also sent notices of legal proceedings to AMSC ASA and its CEO and Chair of the Board, as well as to the CEO and the Chair of the Board (Øyvind Eriksen) of Aker Capital AS. However, no lawsuit has been brought against them at the present time. We reserve the right to expand the case to include one or more of these.

The background to the lawsuit is a number of transactions carried out in relation to the refinancing of Solstad Offshore, which was agreed and announced on 23 October 2023 and completed on 16 January 2024 (the "Transaction").

The Transaction entailed that:

- Companies with a total of 35 of 43 ships and the Solstad group shipping operations (hereinafter the "Solstad fleet") were transferred from the Solstad group to the newly established subsidiary of Aker Capital (Solstad Maritime).

- The former shareholders of Solstad Offshore (other than Aker Capital), which then owned 77.1% of Solstad Offshore, were only given the right to subscribe for a maximum of 13.6% of the shares in the new owner company of the Solstad fleet (Solstad Maritime).

- Solstad Offshore received only 27.3% of the shares in Solstad Maritime in exchange for giving up the Solstad fleet.

Following the Transaction, Aker Capital owns 42% of the shares in Solstad Maritime, and the Aker-associated company AMSC ASA owns 19.6%. In addition, Aker Capital was granted the exclusive right to subscribe for unused subscription rights from the NOK 750 million rights issue aimed at the shareholders of Solstad Offshore. Before the transaction was announced on 23 October 2023, Aker Capital owned 22.9% of Solstad Offshore while AMSC did not own any shares in the company.

The lawsuit was initially filed as a group action to facilitate all affected shareholders having the opportunity to join the lawsuit as group members and to be compensated for their losses. The defendants strongly opposed the lawsuit being brought as a group action. Thereafter, the District Court decided that the case was not to be brought as a group action, but it has allowed other claimants to join the lawsuit instead pursuant to the rules for this regarding ordinary lawsuits. Thus, Kistefos wishes to enable Solstad Offshore shareholders who were owners at the date of the contract on 23 October and/or at the date of the implementation of the Transaction on 16 January 2024 to join the lawsuit alongside Kistefos.

All shareholders who either owned shares in Solstad Offshore at the close of 22 October 2023 or 16 January 2024 are hereby invited to join the lawsuit together with Kistefos under the terms and conditions set out in the present letter.

Kistefos considers that the Solstad fleet was transferred at a significant underprice, and that the shareholder community has been unreasonably discriminated to the benefit of Aker Capital and AMSC. Therefore, Kistefos claims damages from the board members and the CEO of Solstad Offshore and Aker Capital AS for the loss caused to the Solstad Offshore shareholders due to the discrimination and the loss of value in the Transaction. Kistefos also claims damages from Solstad Offshore's financial advisor, Pareto Securities AS, which gave Solstad Offshore advice regarding the Transaction.

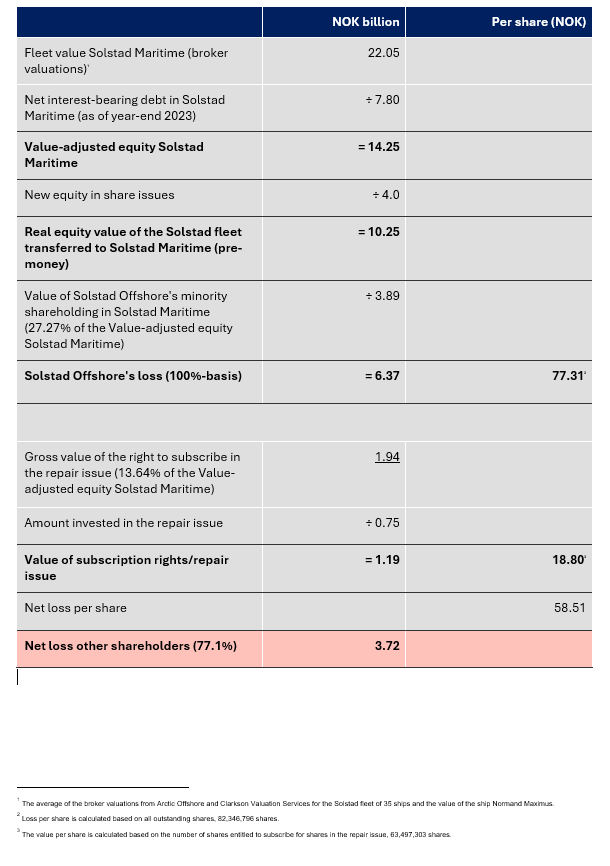

According to Kistefos' preliminary calculations based on broker estimates of the value of the transferred ships, the Transaction has caused shareholder community in Solstad Offshore, apart from Aker, a net loss of NOK 58.51 per share.

In the following, we will provide an overview of the claim for damages and the opportunity for shareholders to join the lawsuit as claimants alongside Kistefos.

2. THE CLAIM FOR DAMAGES

2.1 Introduction

Section 17-1 first paragraph of the Norwegian Public Limited Liability Companies Act establishes a liability for damages that board members, the CEO and shareholders have intentionally or negligently caused to someone in this capacity. It follows from the second paragraph of this provision that those who contribute to causing such loss can be held liable for damages on par with the board members or the CEO.

The damages rule in section 17-1 of the Norwegian Public Limited Liability Companies Act is supplemented by non-statutory rules on the duty of loyalty in business relationships.

Fundamentally, liability for damages requires that three conditions are met: (i) Basis of liability (intent or negligence), (ii) financial loss, and (iii) a causal link between the basis of liability and the financial loss.

Below, an overview of the factual and legal basis for the claim for damages is provided.

2.2 Basis of liability

The claim is directed against the board members and CEO of Solstad Offshore under section 17-1 first paragraph of the Norwegian Public Limited Liability Companies Act for causing the shareholders unnecessary loss through the preparation, decision-making, implementation of and/or contribution to the Transaction involving unlawful dispositions and associated unlawful transfers of value.

The writ of summons argues, and substantiates, that there is a breach of the following legal provisions and non-statutory principles:

- The prohibition against unjustifiable discrimination and abuse of authority in section 6-28 first paragraph of the Public Limited Liability Companies Act;

- The requirement for equal treatment of shareholders in section 5-14 first paragraph of the Norwegian Securities Trading Act (including section 2.1 of the Oslo Stock Exchange's issuer rules on equal treatment);

- The prohibition against unreasonable business methods and the requirement to conduct business in accordance with the conduct of business rules in sections 3-7 and 10-9 of the Securities Trading Act;

- The non-statutory rules requiring loyalty in business relationships;

- The prohibition against unlawful dividends or other unlawful distributions of company assets in section 3-6, cf. section 3-7 of the Private Limited Liability Companies Act and the Public Limited Liability Companies Act; and

- Non-statutory requirements of prudent management in the role as board member according to section 6-12 of the Public Limited Liability Companies Act and as a general manager under section 6-14 of the Public Limited Liability Companies Act.

The lawsuit is also directed against Frank O. Reite, who has caused significant losses to Solstad Offshore and the shareholders through unlawful mixing of roles as a board member of Solstad Offshore, deputy chair of the board of Aker ASA, and board member of AMSC. As a board member of Solstad Offshore, Reite participated in the company's original efforts to negotiate refinancing with the banks. Simultaneously and subsequently, he has been a key facilitator for Aker Capital in developing and negotiating the Transaction on terms that did not promote the common interests of the shareholders in Solstad Offshore, but rather benefitted his own and Aker Capital's special interests.

Reite has also entered into a separate incentive agreement with Aker ASA through the company Converto AS, which regulates his share of the value creation in Solstad Offshore and AMSC. Thus far, Reite has refused to disclose the incentive structure in the agreement but has only presented the agreement in a redacted format. It appears clear that Reite had a particular personal and financial self-interest in promoting the special interests of Aker ASA rather than the common interests of Solstad Offshore and the shareholder community. He has also acknowledged by disqualifying himself from the board work in Solstad Offshore after the proposal for the Transaction was submitted.

On this basis, Frank O. Reite is sued as a board member of Solstad Offshore, but also for losses he has caused the claimants under the rules on contributory negligence and negligence for actions he has performed in other roles. This includes any disloyal or unlawful use of information and knowledge he has obtained as a board member in Solstad Offshore, in his work planning, preparing, facilitating, negotiating, implementing and in any other way assisting with the Transaction to the particular benefit of himself, Aker Capital and AMSC at the expense of the common interests of the shareholders in Solstad Offshore.

Aker Capital is alleged to have represented its own interests and to have acted negligently and disloyally as a shareholder in the planning, preparation, facilitation, negotiation, agreement and implementation of the Transaction. Aker Capital has opposed Solstad Offshore's ongoing process of negotiations with its creditors rather and carrying out the Transaction for the benefit of Aker Capital and AMSC at the expense of the shareholder community. In this context, particular reference is made to the fact that Aker made it clear to the board of directors of Solstad Offshore shortly after its own presentation of 25 September 2023, that Aker would vote against the share issue that was planned in Solstad Offshore ASA and which was to be followed up in a meeting with the banks on 26 September 2023. It is Kistefos' view that there is a basis of liability under section 17-1 first and second paragraphs of the Public Limited Liability Companies Act, as well as under the non-statutory rules on the duty of loyalty in business relationships Aker Capital is also liable for Frank O. Reite's negligent conduct through the rules on compensatory law identification.

Kistefos has also given notice of a lawsuit against the Chair of the Board of Aker Capital, Øyvind Eriksen. After the writ was issued, Kistefos has gained access to audio recordings from board meetings in Solstad Offshore and Pareto's conversations with key people in Aker. The audio recordings show that Øyvind Eriksen has played an active role in Aker Capital's unlawful influence on the process in Solstad Offshore. Kistefos believes the audio recordings provide a significantly strengthened basis for a lawsuit against Eriksen personally. Kistefos will, in consultation with our legal advisors, further consider whether Øyvind Eriksen should be included in the case as a co-defendant. In any case, Aker Capital is also liable for Øyvind Eriksen's possible intentional or negligent, unlawful actions.

In the lawsuit against Pareto Securities, it is claimed that Pareto has acted negligently as a financial advisor for Solstad Offshore in connection with the Transaction. Pareto Securities is held liable under both the non-statutory professional liability and by their actions and omissions negligently or intentionally contributing to the Transaction involving unreasonable discrimination of the shareholders of Solstad Offshore.

In Kistefos' view, Pareto assumed that, independently of Aker, it was entirely possible to secure sufficient injection of equity from existing shareholders and others, either for Solstad Offshore or for the new controlling company of the Solstad fleet (Solstad Maritime).

Shortly after Aker's initial offer was presented to the Board of Directors, Pareto assumed that Solstad Offshore should have independent contact with the banks, and not accept that Aker had this contact alone. Pareto also assumed that it was essential to market test the Transaction and clarify the interest among other potential equity investors.

However, Pareto advised the Board of Directors instead to postpone and eventually refrain from having contact with the banks and alternative equity investors.

In Kistefos' view, instead of providing the Board of Directors with adequate advice to eliminate, counteract and limit the effect of what Kistefos considers as Aker's disloyal pressure, Pareto has adapted their advice to the benefit of Aker and to the detriment of Solstad Offshore and the shareholder community. Pareto eventually advised to negotiate exclusively with Aker without exploring alternatives. Pareto also advised not to consider the Transaction at a general meeting, because the majority of the shareholder community could vote down the Transaction.

2.3 Financial loss

As a result of the Transaction, Solstad Offshore group has been split up, and the majority of the fleet (35 of 43 ships) and the operational shipping business have been transferred to Solstad Marine as a capital contribution at a significantly undervalued price. Aker Capital and its controlled company AMSC have been allowed to subscribe for a disproportionately large number of shares in Solstad Maritime at a significant underprice and discount.

The Solstad fleet is currently owned by a subsidiary of Aker Capital called Solstad Maritime. As a result of the Transaction, Aker Capital took control over substantially all of the business of Solstad Offshore. The transaction was structured in such a way that Aker Capital acquired this control without the Solstad shareholders being given the opportunity to subscribe pro rata for their shareholdings, without triggering the rules on bid obligation and without paying any control premium, and without allowing the shareholders of Solstad Offshore to vote on the proposal in a general meeting. On the contrary, Aker Capital took over the company's assets at a significant underprice and with an additional discount on the underprice.

The Transaction and the unreasonable discrimination have led to significant value and control transfers from the shareholder community in Solstad Offshore to the benefit of Aker Capital and the Aker-controlled AMSC.

The net financial loss for the affected shareholders in Solstad Offshore is provisionally estimated at NOK 3.72 billion based on broker estimates when assessing the undervaluation of the transferred fleet.

See table 1 at the end.

Based on the average broker estimates, the equity value of the Solstad fleet that was transferred is calculated at NOK 10.25 billion, while the Solstad fleet was valued at an equity value of only NOK 1.5 billion in the Transaction. This means that the Solstad fleet was transferred to Solstad Maritime at a significant underprice of NOK 8.75 billion.

Principally, damages are claimed for the affected shareholders' pro-rata indirect share of Solstad Offshore's loss, which is preliminarily estimated to constitute NOK 3.72 billion as shown above.

In the writ, it is alternatively claimed that the shareholders be positioned as if they had received marketable subscription rights with their pro-rata shares in a full-fledged preferential rights issue in Solstad Maritime on equal terms with Aker Capital, and without AMSC, with a total cash contribution of NOK 4 billion.

Kistefos' preliminary estimates indicate that the Transaction has caused minority shareholders in Solstad Offshore a net loss of NOK 58.50 per share as shown above. Kistefos will request an expert with valuation competence for a closer assessment of the size of the loss.

The defendants will presumably submit different estimates, and it cannot be ruled out that the court will rely on other valuations to estimate the loss. The loss estimates may thus be lower than our estimate.

For Norwegian corporate shareholders, damages are also claimed for the total tax disadvantage that arises because they will receive taxable compensation instead of tax-free capital gains under the exemption method, cf. section 2-38 of the Norwegian Tax Act.

The claimants have demanded that the defendants be held jointly and severally liable for the claimants' total financial loss. The board members of Solstad Offshore have reported that they have taken out board liability insurance.

We reserve the right to present other loss items and/or adjust the loss indicated in the writ of summons.

2.4 Causal link

It is the claimants' view that there were other alternatives to the Transaction that would have prevented the draining of Solstad Offshore and/or ensured equal treatment of the shareholder community and thereby prevented the loss suffered by all the shareholders of Solstad Offshore, apart from Aker Capital.

In September 2023, Solstad Offshore had made significant progress in negotiations with its creditors regarding refinancing. There were also good opportunities to secure sufficient new equity in that connection. The Company had been contacted by several financially strong investors among the shareholders for the contribution of the necessary equity. However, the Company and its financial advisors failed to work with such or other alternatives to the Transaction once the Transaction had been presented. The board or its advisors do not seem to have conducted any further explorations of the interest for alternative equity financing in the market. Also, the board has accepted that Aker Capital in reality took over the negotiations with the banks with its proposal to refinance the debt through the Transaction at the expense of the other players of the interests of the shareholder community.

On 12 January 2024, Fearnley Securities presented an alternative refinancing solution to the board of Solstad Offshore. The alternative financing solution consisted of a preferential rights issue totalling NOK 4.2 billion, where NOK 3.25 billion was guaranteed by Pointillist Partners, Christen Sveaas, Songa Capital and MP Pensjon. The proposed solution would have addressed the objections raised against the Transaction regarding discrimination of shareholders in the Company, but this solution was not accepted by the Company. Nor did the Company allow negotiations or clarifications regarding this solution.

There were indisputably other sources of equity on different and better terms for the shareholder community than those offered by Aker Capital and AMSC through the Transaction. It also appears likely that Solstad Offshore, with an alternative equity deposit, would have succeeded in refinancing the debt on acceptable terms without the Transaction. Solstad Offshore conducted constructive negotiations with is creditors when the Transaction was presented. Nor was the Company in a distressed position financially, but indisputably had positive equity and strong expectations of future earnings through concluded contracts and significantly increased rates.

Despite this, the Transaction was implemented, strongly discriminating the shareholder community. Solstad Offshore also raised more equity than the main creditors Eksfin and DNB required for the refinancing, among other things by opening the private placing against AMSC. As a result, the shareholder community's shareholdings and values were further diluted because the Transaction was completed at a significant underprice.

Pareto's advice contributed to Aker Capital being able to exert significant and undue pressure on Solstad Offshore. If Pareto had provided and maintained adequate advice - among other things, that Solstad Offshore should clarify alternative financing with the banks and map the interest among other equity investors - the unreasonable discrimination of the shareholder community would not have taken place. Pareto's advice is a contributory cause of the significant financial loss, and their advice constituted an incitement of the board of directors' decisions. In Kistefos' opinion, the requirement of causal link has been met.

3. KEY MATTERS IN DISPUTE

All the defendants have submitted replies in which they demand that the claim cannot succeed, and they dispute the lawsuit on several independent grounds, including that the Transaction was necessary to secure the refinancing of the Company's debt.

Kistefos has reviewed the replies received from the defendants in collaboration with our legal advisors. Kistefos' view is still that there is a strong likelihood that Kistefos will be successful in a claim for damages, as the case stands today. However, it must be clearly emphasised that there is always risk in such matters, and both the factual and legal aspects of the case can evolve significantly, both during the case preparation and during the court proceedings. There may also be special circumstances which may mean that the claim will not be successful, in whole or in part, for all the defendants. Therefore, Kistefos cannot guarantee the outcome of the cases. At the same time, it is likely that the cases will not be finally decided (legally enforceable) until the Court of Appeal or possibly the Supreme Court. Hence, the legal process may take several years. It must be expected that both sides will incur significant legal costs for extensive proceedings in two courts (District Court and Court of Appeal) in addition to any proceedings before the Supreme Court.

In their reply, the board members and CEO of Solstad Offshore have disputed that the Transactions involve unlawful discrimination of shareholders. They argue that the Transaction was carried out at market value and that the alleged lack of alternatives provided a factual and reasonable basis for discriminating against the shareholders in Solstad Offshore in the issuances in Solstad Maritime. In this context, they argue that the most likely alternative to the Transaction would have been default on the Company's debt obligations or refinancing of the debt on terms that would have eliminated the shareholders' equity values. They also argue that the threshold is high for reviewing such business assessments that formed the basis for the Transaction, cf. HR-2022-2484-A section 54.

Frank Ove Reite, for his part, disputes disloyal or unlawful use of information and knowledge to the benefit of Aker Capital. Reite refutes that he has acted negligently or unlawfully. Reite also submits that it has not been sufficiently concretised that he has acted in a manner giving rise to damages. He has also specifically pointed out that after the solution of the Transaction was presented to the board, he declared himself disqualified as a board member in Solstad Offshore and thus did not participate in or incite the board's decision to carry out the Transaction.

Aker Capital disputes in its reply that they have contributed to obtaining an unreasonable advantage and enriched themselves at the expense of other shareholders or the Company. Aker Capital argues that the Transaction was the result of commercial negotiations, and that Aker Capital has not contributed to or incited any liability-inducing decisions in Solstad Offshore.

Pareto Securities argue that they have acted cautiously in advising Solstad Offshore and in any case that the shareholders have not disposed in confidence of the advice that was intended for Solstad Offshore as their client. In any case, they also dispute that the advice is of a nature that can be considered contributory under section 17-1 second paragraph of the Public Limited Liability Companies Act. Pareto refers to that it provided balanced advice and that, in any case, Pareto did not incite the Board of Directors to breach the equal treatment requirement. It is also stated that the mandate agreement concluded with Solstad Offshore contains limitations of liability that limit the shareholders' claims for damages.

A common feature of the replies is moreover that all the defendants have disputed that the conditions for financial loss and causal link are met. They have particularly argued that there were no realistic alternatives to the Transaction since the lending banks are said to have set as a condition that Aker Capital entered as an anchor investor in the refinancing. Aker Capital would not have agreed to alternative solutions. It is also submitted that it was not likely that Solstad Offshore would have reached a refinancing agreement with its creditors as an alternative solution to the Transaction. Further, they argue that the Transaction was the only option that would simultaneously provide a solution to the impending expiration of the so-called Maximus claim. All the defendants have referred to the Supreme Court case Rt. 2004 page 1816 (Skiltmaker) and subsequent case law and legal theory regarding shareholders' tort protection to reject that shareholders in Solstad Offshore can be compensated for their pro-rata share of Solstad Offshore's company loss (indirect loss).

In our legal advisors' assessment, the defendants' arguments cannot succeed. It is also our legal advisors' view that the lawsuit has been strengthened by new evidence from the replies. For instance, the presented evidence supports the claim that the Transaction was not based on real market values and thus also involved unlawful value transfers to Aker Capital and AMSC at the expense of the shareholder community. Pareto changed its initial advice to the Board of Directors to contact the banks and potential equity investors following the contact with Eriksen.

Neither Solstad Offshore nor their financial advisor has been able to document that they to a sufficient extent explored alternative solutions, or that they implemented sufficient measures to ensure equal treatment of the shareholder community, before Solstad Offshore made a binding commitment to the Transaction. Also, it does not appear likely that alternative financing of the debt in Solstad Offshore would have failed without the Transaction. This includes any resolution of the Maximus claim.

Furthermore, the Transaction was carried out without it being considered by a Solstad Offshore general meeting. The demand to dispense with the general meeting procedure was made by Aker Capital. Also, key Aker Capital representatives exerted considerable pressure on Solstad Offshore and its representatives and advisors. The demand to waive the general meeting procedure cannot be explained in any other way than that Aker Capital understood that the value transfers and discrimination of shareholders would not have been accepted by the shareholder community at the general meeting.

Key evidence also supports that Frank O. Reite has caused significant loss to Solstad Offshore and the minority shareholders through unlawful mixing of the roles as board member of Solstad Offshore, deputy chair of the board of Aker ASA, board member of AMSC and as a personal consultant under an agreement between Aker and his company Converto AS. During the proceedings, Reite has changed roles from being a representative of Solstad Offshore towards the banks in the company's attempt to refinance their debt to becoming a representative of Aker Capital in the negotiations on the Transaction. How Reite has acted in this regard will be a key evidentiary issue in the case.

In Kistefos' view, Pareto's advice and failure to clarify whether there were alternative solutions other than the Transaction to bank financing and equity financing constitute a clear breach giving rise to damages of the mandatory statutory requirement to conduct business in accordance with the conduct of business rules, a requirement which, among other things, shall protect the shareholders of Solstad Offshore. The contribution is based on Pareto's direct incitement of the Board of Directors' choice to negotiate further with Aker and without clarifying whether there were alternatives to bank financing.

Regarding the question of financial loss, it is disputed whether shareholders have the legal right to claim damages for their share of the Company's loss. It is disputed whether this type of indirect shareholder loss generally has legal protection under tort law. In this context, the defendants have referred to the Supreme Court judgment Rt-2004-1816 (Skiltmaker judgment) and subsequent case law and legal theory. Our advisors' view is that the reference to the Skiltmaker judgment is not relevant for our case since that specific case concerned a tortious act against the shareholder himself, while our case concerns a tortious act against the company (Solstad Offshore) which also indirectly affected the shareholders. The Supreme Court judgment in HR-2020-1947-A (Akademiet) and several related legal sources support that such indirect losses incurred due to unreasonable discrimination are protected under tort law as regards the shareholders. In the Akademiet case, a shareholder of a company received damages for indirect loss after abuse of authority and disloyalty from a co-shareholder in the group.

Alternatively, Kistefos has put forward a claim that the Solstad shareholders should be financially positioned as if they had received subscription rights that allowed them to maintain their shareholdings in Solstad Offshore (77.1%) in the new controlling company (Solstad Maritime). This must be considered a special loss (direct loss) and thus a different form of loss than what is dealt with in the Skiltmaker judgment

Regarding the question of causal link, the evidence in the case suggests that it was possible to carry out alternatives to the Transaction that grossly discriminated against the shareholder community and significantly diluted their values. This will be a central question for the hearing of evidence in the case.

4. REPRESENTATION, HOW TO JOIN AS A CLAIMANT, FINANCING ETC.

4.1 How eligible shareholders can join the proceedings

Prior to the opening of the stock exchange on the morning of 23 October 2023, the transaction agreement between Solstad Shipholding and Aker Capital was concluded. The same morning, the terms of the Transaction were announced over the stock exchange. On 16 January 2024, it was announced that the Transaction was completed. As the Transaction was entered into and announced prior to market opening on 23 October 2023, it will in practice be shareholders at the end of 22 October 2023 who will be affected.

Kistefos considers that it was tortiously negligent to enter into and to complete the agreement on the Transaction. The lawsuit is thus relevant for Solstad Offshore shareholders who owned shares immediately prior to either the announcement on the morning of 23 October 2023 or the completion of the Transaction on 16 January 2024.

On this basis, all shareholders who either owned shares in Solstad Offshore on 22 October 2023 or on 16 January 2024 are hereby invited to join the legal proceedings as claimants and to claim damages for their losses. This also includes shareholders who owned different numbers of shares at the two given dates.

However, claimants who joint the lawsuit must be aware that the court cannot award damages for the same loss several times for shares that have been traded during the period. The starting point is thus that the court must be expected to find that either the date of agreement or the date of execution constituted the date of loss for the affected minority shareholders. There is also a risk that the court will consider that shareholders must have been owners at both cut-off dates in order to be entitled to (full) compensation. This means that shareholders who only owned Solstad Offshore shares on one of the dates may run the risk of not being awarded damages, even if the conditions for compensation are otherwise considered fulfilled. Similarly, shareholders who held a different number of shares on the two dates may not receive compensation for all their shares.

In our view, the board of directors had the right to prevent the implementation of the Transaction even after the agreement was concluded on 23 October 2023. This is because it constitutes such unreasonable discrimination that it must be considered non-binding for Solstad Offshore. Kistefos will therefore principally submit that it is the completion date of 16 January 2023 which should be used as a basis in the loss calculation.

The eligible shareholders may elect to join the legal proceedings as claimants in case no. 24-078941TVI-TOSL/04 (against the board/management of Solstad Offshore and Aker Capital as defendants) and/or 24-078937TVI-TOSL/04 (against Pareto Securities as defendant):

- To join the legal proceedings as a claimant against the board and management of Solstad Offshore and Aker Capital, please fill out the Reply form and Power of Attorney attached as Appendix 1, and send it by e-mail to solstadskandalen@kistefos.no, or by post to Advokatfirmaet Wiersholm AS, P.O Box 1400 Vika, 0115 Oslo.

- To join the legal proceedings as a claimant against Pareto Securities, please fill out the Reply Form and Power of Attorney attached as Appendix 2, and send it by e-mail to solstadskandalen@kistefos.no, or by post to Nordia Law Advokatfirma, Dronning Eufemias gate 8, 0191 Oslo.

Please also provide and attach evidence of your shareholding in Solstad Offshore on 22 October 2023 and on 16 January 2024, respectively (as set out in the Reply Form and Power of Attorney). Our legal advisors will then consider whether the conditions for joining the proceedings as a claimant have been met.

If the shares are owned by a company, the form must be signed by both the Chair of the Board and by the person(s) having signatory authority for the company.

For the sake of the ongoing case preparations, we kindly ask for your confirmation by 23 December 2024.

By joining the proceedings, you accept the terms and conditions set out below. When joining, you will also be given access to a digital data room containing the case documents (writ, replies, pleadings, exhibits, etc.).

4.2 Legal fees and liability for the opposing party's costs

On 16 May 2024, Kistefos initially filed two group actions to enable the shareholder community to jointly recover their losses. Alternatively, Kistefos demanded that the cases should proceed in accordance with the ordinary rules on general proceedings. The cases were refused brought as group actions by the District Court, but the two cases are now pending as ordinary lawsuits and are merged to be dealt with jointly before Oslo District Court. Kistefos still wants to facilitate that other affected shareholders may join the lawsuits as claimants in the same cases under the rules of so-called joinder of parties.

We have engaged lawyer Olav Fr. Perland from Advokatfirmaet Wiersholm as legal counsel in the case against the board/management of Solstad Offshore and Aker Capital. Lawyer Helge Skogset Berg from Advokatfirmaet Nordia has been engaged as legal counsel in the lawsuit against Pareto Securities, and as legal counsel in the case against the board/management in Solstad Offshore and Aker Capital. This letter has been written in consultation with Kistefos' legal advisors.

Thus far, Kistefos has paid the legal fees to the legal counsels for, among other things, the preparation of a notice of legal proceedings, writ of summons and follow-up of a number of requests for evidence that have been necessary to get an overview of the case and the transaction structure. This will be included in the costs to be distributed between all the claimants. The distribution of costs will be calculated per share. Due to the scope and complexity of the case, it must be expected that the total legal costs will be significant.

Kistefos has also incurred significant costs related to legal assessments and various processes prior to the work with the notice of legal proceedings and the writ in these cases. These costs will be borne by Kistefos alone and will not be distributed to the litigation community.

The legal fees and other litigation costs relating to the lawsuit will be divided between the claimants participating in the legal action, relative to their share of the total claim (based on the number of shares). The ratio is calculated based on the highest number of shares a claimant owned on either 22 October 2023 or on 16 January 2024.

In respect of shareholders with fewer than 20,000 shares, Kistefos will undertake to advance the legal costs for claimants who do not wish to be invoiced on an ongoing basis for their relative share of the legal costs. In that case, the claimants' share of the legal fees and costs (calculated on the basis of each shareholder's relative share of the total claim) will only be invoiced after the case has been finally settled, either by final court decision or by settlement. For the outlay, Kistefos will charge an annual interest rate of 5% for the number of interest days the legal costs are advanced.

In respect of the remaining shareholders, Kistefos will, as a prerequisite for participation in the lawsuits, request advance payment of an amount for legal costs. The amount is NOK 2 per share for participation in the lawsuit against the Board of Directors/management of Solstad Offshore and Aker Capital and NOK 0.5 per share for the lawsuit against Pareto. The amount shall be paid into the client account of the counsel in accordance with further payment instructions. The advance payments may be used to cover the relevant share of the running costs as they fall due. For such shareholders, payment of the advance payment is a prerequisite for joining the lawsuit. The legal costs may be higher, and the advance payment is no a guarantee of the final size of the legal costs. Nor does the advance payment include the legal costs of the defendants.

Once a shareholder has been granted the status of claimant, the shareholder in question will, as a main rule, not be able to later withdraw from the case without having to cover legal costs incurred thus far in the case, both by their own and the opposing party's lawyers. However, the shareholder will not be liable for any legal costs incurred thereafter.

If the claims are successful, the costs and fees attributable to each of these shareholders in excess of what they have already paid in advance or along the way will be deducted from the amount of damages payable to each shareholder (in the event that legal costs are not fully covered by the opposing parties). By joining the action, you consent to Kistefos making such deduction from the share of the amounts paid in the payment of the claim for damages to each claimant. Claimants are requested to note that the court may reduce the compensation for legal costs incurred, even if the claimants are successful in the lawsuits. In that case, this entails that the shareholders will not be fully reimbursed for their legal costs by the opposing party. However, it does not entail any change in the internal distribution of legal costs on the claimants' side.

In the event the claims are unsuccessful, each of the shareholders having joined as claimants is liable for their own share of their own legal costs and for their relative share of the legal costs and expenses that are awarded. In this context, a supplementary settlement will be made with the shareholders who have paid the legal costs thus far. This amount will be calculated per share so that it is the number of shares owned by the shareholders participating as claimants which will determine how much the individual must pay in such a case.

In the event the claimants are unsuccessful, the main rule is that they are liable for paying the opposing party's legal costs. If the defendants are awarded legal costs by the courts, it cannot be ruled out that the shareholders will be held jointly and severally liable for these case costs. However, the claimants will claim that the liability for costs should be allocated pro rata. However, the liability between the shareholders for such potential joint and several liability shall be allocated within the claimant group according to their relative shares of the total claim.

If the shareholders are held jointly and severally liable, and the defendants enforce their total claim against one single or several shareholders making such claims, these shareholders will have a recourse right against each of the other shareholders for the shareholders' relative share of the liability. If shareholders have deceased, gone into bankruptcy or for other reasons are unable to pay their share, such share of the liability will be split between the remaining shareholders in accordance with their relative shares (as set out above).

By participating as a claimant in these proceedings, you acknowledge that you may become liable for the legal fees and costs of both sides in proportion to your share of the aggregate claim on the terms set out above.

For the administration of the lawsuit, Kistefos will calculate a fee of 3% of any net amount of damages awarded in the cases (less legal costs that may not have been awarded). Kistefos will only be entitled to such fee if the cases end with payment to the plaintiffs and calculated on the basis of the amount paid. The success fee will also be deducted from the amount of damages that may be awarded to each shareholder in the same way as legal costs advanced by Kistefos.

The law firms' standard terms and conditions will apply to the engagements. These will be forwarded upon registration or further request.

4.3 Power of attorney

To ensure the most efficient management of the case, Kistefos shall represent the whole group of claimants, both in strategic and procedural decisions, and in negotiations for a potential settlement.

All shareholders who wish to participate in the lawsuit against the board of directors / management of Solstad Offshore and Aker Capital must sign the attached Power of Attorney (in Appendix 1), while shareholders who wish to participate in the lawsuit against Pareto Securities must sign the attached Power of Attorney in Appendix 2.

The power of attorney authorizes Kistefos (represented by its CEO Bengt A. Rem) to make all strategic and procedural decisions, and to settle the claims, on their behalf in the relevant lawsuit. The pleadings and submissions will be shared and discussed between the appointed lawyers and Kistefos before they are filed, but generally not with the other claimants.

Furthermore, Kistefos will participate in any settlement negotiations with the defendants and is authorized to enter into any settlement on behalf of the claimants on their sole discretion.

All who join the proceedings as claimants will be able to review the court documents by requesting access to a data room. We emphasize that these documents are not available to the public, and all participants in the lawsuit who are granted access are encouraged treat the documents and information therein confidentially.

4.4 Subsequent share transactions

The Transaction was announced on 23 October 2023 and completed on 16 January 2024.

Each shareholder's claim for damages is thus based on the number of shares that the shareholder owned in Solstad Offshore at the end of 22 October 2023 and at the end of 16 January 2024. However, the starting point is that the court will fall down on only one of the cut-off dates when assessing the loss. This means that shareholders who only owned Solstad Offshore shares on one of the dates may risk not being awarded damages, even if the conditions for compensation are otherwise considered to be met.

The defendants have also submitted that shareholders who purchased shares after the announcement of 23 October 2023, have accepted the Transaction. Kistefos does not agree with this. Kistefos has itself purchased shares in Solstad Offshore after the Transaction was announced. This did not imply any "acceptance" of the Transaction but was related to a desire to strengthen our position in the company in an attempt to ensure equal treatment of the Solstad shareholders. Kistefos has also negotiated with Aker with the aim of achieving equal treatment of the Solstad shareholders, but to no avail.

Shareholders who owned different numbers of shares on the two dates thus risk not being awarded damages for the highest number of shares they held.

Shareholders that have sold their shares after 16 January 2024 can also join the proceedings. Joining shareholders, if they owned shares either on 22 October 2023 or 16 January 2024, may also sell Solstad Offshore shares while the case is pending before the courts.

Consequently, the claim for damages is in any case not affected by transactions made after 16 January 2024.

5. APPENDICES

Please see the following appendices to this invitation letter:

2) Reply Form and Power of Attorney – lawsuit against Pareto Securities AS

****

Yours sincerely,

Kistefos AS

Bengt A. Rem

CEO